Insights And Ideas From Mortgage Masters Ltd.

New Year, New Home: Your Complete Step-by-Step Guide to Buying Your First Home in New Zealand

The dawn of a new year often inspires fresh goals and aspirations. For many, 2025 could be the year to achieve the dream of homeownership.

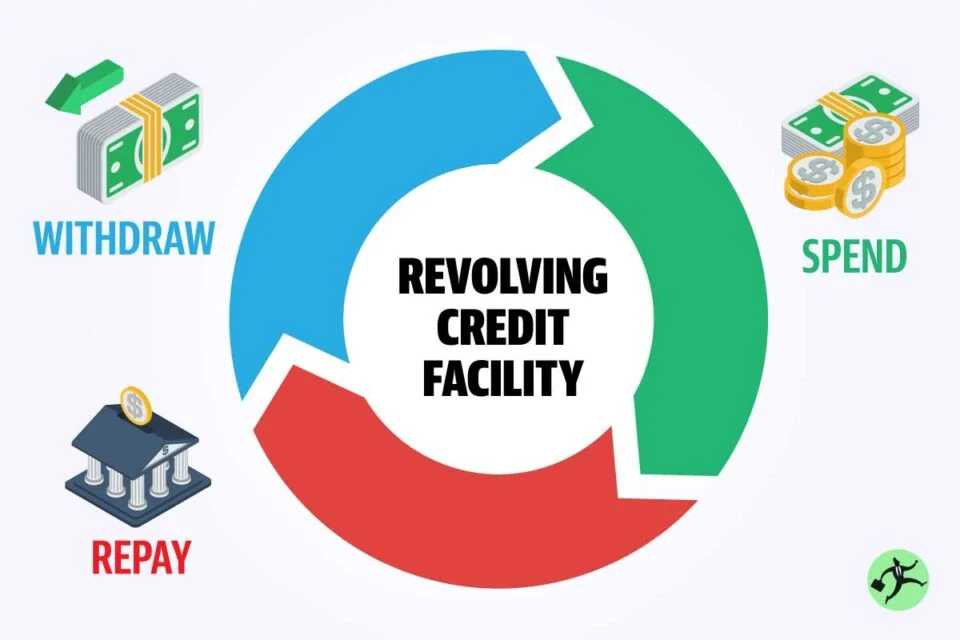

What is a Revolving Credit Mortgage and 7 Smart Ways to Use it

If you’re navigating the world of mortgages in New Zealand, you might have come across the term “revolving credit.” But what exactly is it, and

How to Boost Your Mortgage Approval Chances in a Competitive Market

Securing a mortgage in today’s dynamic and highly competitive housing market can be challenging. Lenders are becoming more stringent, and with increased demand for properties,

The Role of Interest Rates in the New Zealand Mortgage Market: A Comprehensive Guide by Mortgage Masters

Interest rates play a pivotal role in the New Zealand real estate market. Interest rates can influence everything from mortgage affordability to property prices. Understanding

Auckland Property Market Update: What First Home Buyers Need to Know in 2024

First home buyer’s checklist for Aucklanders in 2024 As 2024 unfolds, the Auckland property market continues to present unique opportunities and challenges for first home

Major Changes to Mortgage Rules by the Reserve Bank: What It Means for You

The Reserve Bank of New Zealand has confirmed significant changes to mortgage lending rules, effective from July 1, 2024. These changes will ease loan-to-value ratio

The Benefits of Working with a Mortgage Broker: How We Can Help You

Navigating the complex world of mortgage options, interest rates, and lenders can be overwhelming and time-consuming. Securing a mortgage to purchase a home is one

Exploring Fixed-Rate Mortgages vs. Floating Rates in New Zealand: Making Informed Financial Choices with Mortgage Masters

In the realm of mortgage financing in New Zealand, one of the most crucial decisions borrowers face is whether to opt for a fixed-rate mortgage

Learn 5 benefits of working with Mortgage Masters in New Zealand

A mortgage broker’s function is unquestionably valuable in the tapestry of New Zealand’s real estate environment. With our experience, network, and commitment to your financial