If you’re navigating the world of mortgages in New Zealand, you might have come across the term “revolving credit.” But what exactly is it, and how can you make the most of it? This blog covers what revolving credit is, its key differences vs offset accounts, and seven smart ways you can use it as part of your financial strategy.

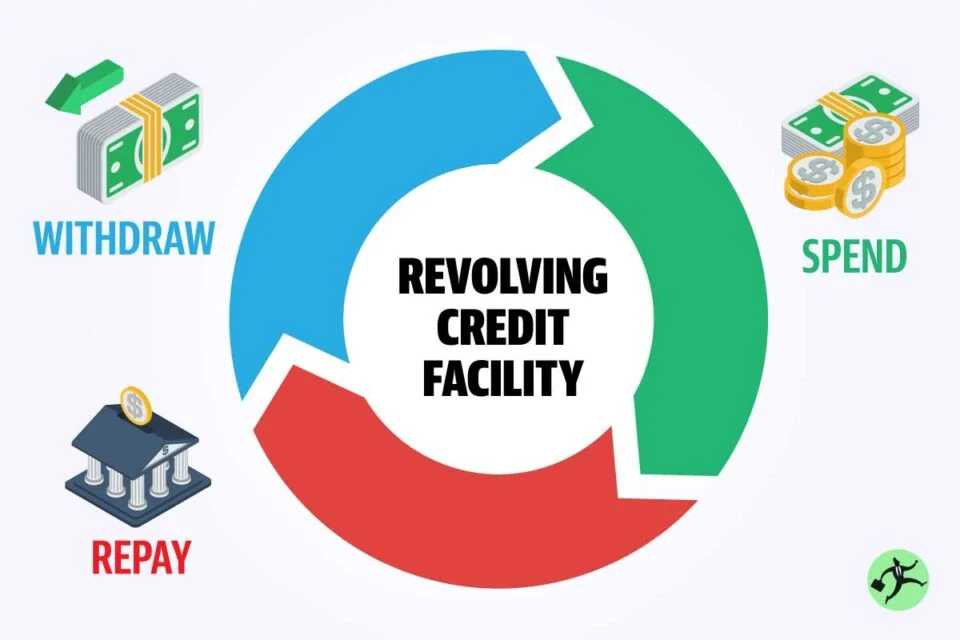

What is a Revolving Credit?

Revolving credit is a flexible mortgage option that operates like an overdraft. It involves splitting your mortgage into two parts: a fixed portion (e.g., $450,000) and a smaller portion (e.g., $50,000) set up as a revolving credit account with a floating interest rate. Any funds deposited into the revolving credit account directly reduce the balance on which interest is calculated. For example, if you have $30,000 in your revolving credit account, you only pay interest on the remaining $20,000 instead of the full $50,000. This arrangement allows your savings to offset mortgage interest costs while remaining accessible for emergencies or other needs.

Difference between revolving credit and offset account

Keep in mind that not all banks in New Zealand offer both revolving credit and offset mortgages. While these two options are similar, there are differences.

A revolving credit facility requires you to deposit money directly into the account to reduce the mortgage balance and lower the interest charges. In contrast, an offset loan links multiple savings accounts to the mortgage, calculating interest on the loan balance minus the total savings across all linked accounts. For example, with a $50,000 mortgage and $30,000 across savings accounts, interest is calculated on $20,000 instead of the full $50,000. Offset loans provide greater flexibility by allowing multiple accounts, whereas a revolving credit facility uses a single account.

In terms of repayment, a revolving credit facility operates on a principal & interest basis (with the principal-and-interest option, part of the loan is automatically repaid during each cycle, ensuring the loan is paid off within a predetermined time frame, such as 25 years) or interest-only basis, where any extra money deposited directly reducing the owed balance.

On the other hand, offset loans offer both interest-only and principal-and-interest options. With the principal-and-interest option, part of the loan is automatically repaid during each cycle, ensuring the loan is paid off within a predetermined time frame, such as 25 years. The aim would be to pick a method that would help you make repayments faster.

Offset and revolving credit facilities loans may provide greater control and flexibility, especially for investors managing multiple accounts for personal and rental properties.

How to Use Revolving Credit in Your Mortgage Strategy

Many homeowners use revolving credit as a strategy to pay down their mortgage faster. Here’s how:

- Set a Clear Goal: If you allocate $50,000 as revolving credit within a $500,000 mortgage, you’ll have a more manageable target to aim for, as opposed to focusing on the entire mortgage balance. This gives you a sense of progress and achievement as you reach your goals.

- Flexible Payments: Unlike fixed mortgage payments, revolving credit payments are either interest only on the month on month owed balance or principal and interest depending on which option is available.

If you find you need some of the money back after over-saving, you can withdraw funds up to the limit available without needing a new mortgage application. - Increased Borrowing Power for Investors: Because additional payments toward revolving credit are voluntary, they don’t impact your borrowing capacity as much as fixed payments.

When to use the Revolving Credit Facility

A revolving credit facility is ideal for those seeking liquidity and flexibility. It allows users to withdraw funds as needed, offering a financial safety net for unexpected expenses, such as car repairs, without affecting the main mortgage. This setup is particularly beneficial for freelancers or business owners with variable income, as it enables lump-sum deposits to reduce interest charges without adhering to a strict repayment schedule. However, revolving credit facilities often carry higher floating interest rates compared to fixed mortgages, which can fluctuate over time and impact repayment amounts. Additionally, successful use demands strong financial discipline, as mismanagement—such as withdrawing funds for unnecessary expenses—can negate its benefits.

Seven Smart Ways to Use a Revolving Credit

- Home Renovations: Rather than topping up your mortgage for a $50,000 renovation, consider using revolving credit. You’ll only pay interest on the funds used for each phase of the project, rather than the entire $50,000 upfront.

- New Build Investment Property: Setting up revolving credit to cover the full deposit on a new-build property can ensure you’re ready when construction is complete, typically a year later.

- Managing Property Investment Cash Flow: Investment properties often require top-ups for cash flow. Revolving credit can smooth out irregular expenses, allowing you to cover any shortfall without dipping into other finances.

- Financial Cushion for Redundancy: In uncertain times, a revolving credit line can act as a safety net. If you lose your job, having this pre-approved credit can help you cover expenses while finding new employment.

- Interest Savings with Spare Cash: If you have cash set aside for an upcoming trip or major expense, you can deposit it into your revolving credit account in the interim. This reduces your mortgage interest until you need the funds.

- Handling Irregular Income: Freelancers or business owners can benefit from depositing income as it arrives, using revolving credit to manage the periods between payments.

- Affordable Financing for Big Purchases: Setting up revolving credit can be a cost-effective way to fund large purchases like a car. The interest on revolving credit is generally lower than financing through a personal loan, making it a smart option for planned expenses.

Conclusion

Revolving credit can be a powerful tool for homeowners who want flexibility and control over their mortgage payments but require clear goals and discipline. It is essential to understand both its benefits and potential pitfalls to use it wisely. Whether you’re using it to fund renovations, save on interest, or manage cash flow, a well-managed revolving credit can make your financial journey smoother and more cost-effective. A well-structured strategy can always help you save money. Here at mortgage masters our advisors will look at your circumstances and give you the right recommendation for your mortgage strategy.

For more mortgage insights, don’t forget to check out our other posts on Mortgage Masters.